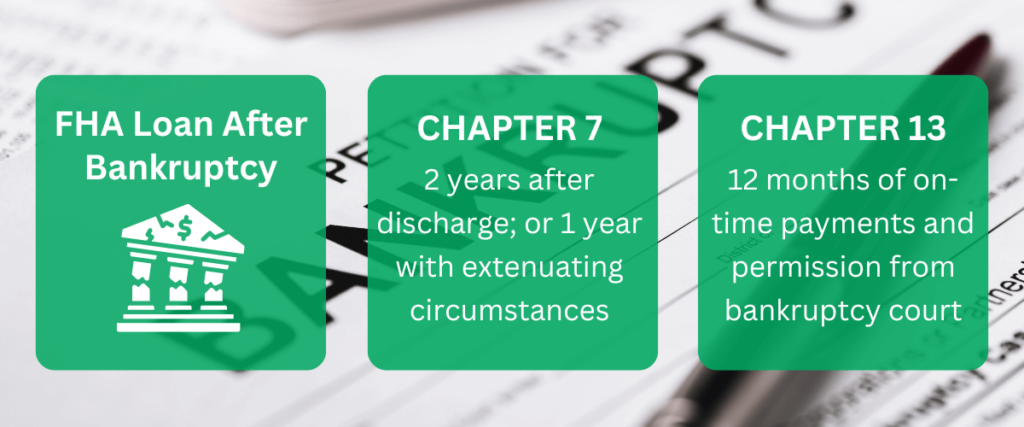

It’s possible to qualify for an FHA loan after a bankruptcy filing. Depending on the circumstances, there might be a waiting period of 12 months to two years from the discharge date.

Here’s a summary of the rules and guidelines that are explained in detail below:

- After a Chapter 7 bankruptcy, you’ll typically need to wait two years from the discharge date to qualify for an FHA loan. You’ll need to have re-established good credit or have no new credit obligations. In some cases, if the bankruptcy was due to extenuating circumstances, the waiting period might be reduced to one year.

- With a Chapter 13 bankruptcy, you can become eligible for an FHA loan after making at least 12 months of on-time payments within your plan. You’ll also need permission from the bankruptcy court to obtain the mortgage.

Getting an FHA Loan After Bankruptcy

The FHA loan program can be a good option for borrowers who can’t qualify for conventional financing. This program tends to be more forgiving, when it comes to basic borrower eligibility and qualification requirements.

Bankruptcy is one of the areas where the FHA program offers some flexibility and “forgiveness.” It’s possible to qualify for an FHA-insured mortgage loan after a Chapter 7 or Chapter 13 bankruptcy filing, once the borrower has met a certain waiting period and other requirements.

The rules are different depending on the type of bankruptcy filing (Chapter 7 versus 13). So let’s examine them one at a time.

Automated vs. Manual Underwriting

The FHA loan program falls under the Department of Housing and Urban Development (HUD). So it’s HUD that establishes all criteria and requirements for this program. And they have specific guidelines for borrowers who want to use an FHA loan to buy a home after a bankruptcy filing.

There’s an important distinction here regarding manual vs. automated underwriting. During the FHA loan “underwriting” process, the mortgage lender’s underwriter will review all aspects of the borrower to make sure they meet the minimum requirements for this program.

Underwriting can be done in two ways: manually by a human, or through an automated underwriting system (AUS). Manual underwriting is generally more strict and takes longer, since the underwriter will likely ask a lot of questions.

And here’s where the bankruptcy distinction comes into the picture:

- If at least two years have passed since the bankruptcy was discharged, the loan can be processed with automated underwriting. (The faster, more streamline path.)

- If the bankruptcy was discharged within two years from the date of case number assignment, the loan must be manually underwritten. (The slower path involving more human review.)

In other words: If less than two years have passed since the bankruptcy discharge date, the mortgage lender has to push the “pause button” and take a closer look at the loan file. They must ensure that specific requirements have been met, as explained in the next two sections.

Guidelines for Chapter 7 Filing

Also known as a “liquidation bankruptcy,” Chapter 7 involves the sale of a debtor’s nonexempt property by a trustee appointed by the court. The proceeds from this sale are used to repay creditors.

In most cases, individuals filing for Chapter 7 bankruptcy are allowed to keep certain exempt property, like their primary residence and essential possessions.

As it states on the IRS website:

“Chapter 7 provides relief to debtors regardless of the amount of debts owed or whether a debtor is solvent or insolvent. A Chapter 7 Trustee is appointed to convert the debtor’s assets into cash for distribution among creditors.”

Chapter 7 bankruptcy typically lasts around three to six months, after which the debtor receives a “discharge,” meaning they are no longer obligated to repay the discharged debts. This type of bankruptcy is often used by individuals with significant unsecured debts, such as credit card debt or medical bills.

Qualifying for an FHA loan after chapter 7 bankruptcy:

In many cases, borrowers can still qualify for an FHA-insured mortgage loan after filing a Chapter 7 bankruptcy. According to the official HUD handbook:

“A Chapter 7 bankruptcy (liquidation) does not disqualify a Borrower from obtaining an FHA-insured Mortgage if, at the time of case number assignment, at least two years have elapsed since the date of the bankruptcy discharge.”

During the two-year time frame mentioned above, the borrower must have:

- re-established good credit; or

- chosen not to incur new credit obligations.

In some cases, the “waiting period” for getting an FHA loan after Chapter 7 bankruptcy can be shorter than two years (but not less than 12 months). This is possible if the borrower can show that the bankruptcy was the result of extenuating circumstances beyond their control, like a job loss due to a company downsizing.

Additionally, the borrower must be able to exhibit a “documented ability to manage their financial affairs in a responsible manner.” It’s up to the mortgage lender to determine these things, and to document them accordingly.

Guidelines for Chapter 13 Filing

Referred to as a “reorganization bankruptcy,” Chapter 13 involves creating a repayment plan that allows debtors to repay all or a portion of their debts over a three to five-year period. Individuals who file Chapter 13 bankruptcy can keep their property and assets while making regular payments to a trustee, who then distributes the funds to creditors.

Chapter 13 bankruptcy is typically used by individuals who have a regular income but are struggling to repay their debts. It can help prevent foreclosure on a home or repossession of a vehicle by allowing the debtor to catch up on missed payments over time.

As it states on the IRS website:

“Chapter 13 bankruptcy is only available to wage earners, the self-employed and sole proprietors (one person businesses). To qualify for Chapter 13, you must have regular income, have filed all required tax returns for tax periods ending within four years of your bankruptcy filing and meet other requirements set forth in the bankruptcy code.”

Qualifying for an FHA loan after chapter 13 bankruptcy:

Here’s what the handbook says about getting an FHA loan after a Chapter 13 filing:

“A Chapter 13 bankruptcy does not disqualify a Borrower from obtaining an FHA-insured Mortgage, if at the time of case number assignment at least 12 months of the pay-out period under the bankruptcy has elapsed.”

Additionally, the mortgage lender must ensure that, during the time period mentioned above, the borrower’s payment performance “has been satisfactory and all required payments have been made on time.” The lender must also determine that the borrower has received written permission from the bankruptcy court to take on a mortgage loan.

Individuals filing Chapter 13 must also have enough residual income left over each month to pay back at least a portion of their debts through a repayment plan.

The documentation requirements for Chapter 13 are similar to those mentioned earlier. The lender can use credit reports or bankruptcy / discharge documents, as appropriate. The mortgage lender is also required to document that the borrower’s “current situation indicates that the events which led to the bankruptcy are not likely to recur.”

5 Key Takeaways From This Guide

We’ve covered a lot of information here, and this can be a confusing subject due to all of the variables involved. So let’s wrap up with a simplified summary.

Here are the five most important things you should know about getting an FHA loan after a bankruptcy filing:

- Chapter 7: Wait 2 years after discharge (unless extenuating circumstances).

- Chapter 7: Re-establish good credit or avoid new credit obligations.

- Chapter 13: Must be at least 12 months into the repayment plan.

- Chapter 13: Must have a satisfactory payment history.

- Chapter 13: Need written permission from bankruptcy court for the mortgage.

Disclaimers: All quoted portions of this article came directly from HUD Handbook 4000.1 (but we are not directly associated with HUD). This article is not meant to take the place of professional legal or mortgage advice. Portions of this article might not apply to your specific situation. The information above is deemed accurate but not guaranteed. If you have questions about this program, you can refer to HUD.gov or send an email to answers@hud.gov.