In this guide: An overview of the maximum FHA loan amounts for 2024, with an explanation of how they can affect you as a home buyer and borrower.

The FHA loan program allows eligible borrowers to purchase a home with a down payment as low as 3.5%. This program also offers more flexible qualification criteria, when compared to conventional / regular home loan.

However, there’s a maximum amount you can borrow when using an FHA loan to buy a house, and these caps are commonly referred to as “FHA loan limits.”

Maximum FHA Loan Amounts in 2024

In 2024, the maximum mortgage amounts for a single-family home range from $498,257 to $1,149,825. They vary depending on the county where the home being purchased is located.

Those are the official limit for borrowers, according to the Federal Housing Administration. But your mortgage lender will also evaluate your income and debt situation, to determine how much you can borrow with an FHA loan.

The bottom line: Not everyone can borrow the maximum FHA loan amount for their specific county. Borrowers must have enough income to manage their monthly payments, on top of all other recurring debts.

Ultimately, this is how lenders decide how much you can borrow.

How to Find the Limits for Your County

The maximum FHA loan size can vary by county, because it’s partly based on median home values (which also vary by location). Counties with higher home prices tend to have higher loan limits, and vice versa.

But as a home buyer, you really only need to know the maximum FHA loan size for the specific county where you plan to buy. The nationwide range mentioned above isn’t very helpful. So let’s get local…

Here’s how to find the loan limits for your county:

- Visit the official website: https://entp.hud.gov/idapp/html/hicostlook.cfm.

- Enter your state and county in the fields provided.

- Make sure the “limit type” is set to “FHA Forward.”

- Make sure the “limit year” is set to 2024.

- Click the “send” or “submit” button.

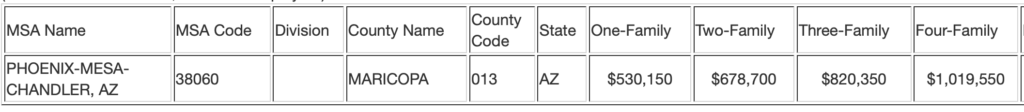

After completing these steps, you’ll be presented with a page that resembles the screenshot example below. (You can click to enlarge it.)

This example shows the 2024 FHA loan limits for Maricopa County, Arizona. The “one-family” column applies to regular single-family homes. The “two-family” column shows the limit for duplex style properties, and so on.

How All of This Affects You as a Borrower

The maximum FHA loan amounts limit how much you can borrow when using an FHA loan to buy a home. If the property you want to buy exceeds the HUD-imposed limit for your county, you’ll need to make a larger down payment to cover the difference.

Alternately, you could use a conventional loan to finance your purchase, since those products often have higher limits when compared to the FHA program.

In high-cost real estate markets like San Francisco, California and Washington, D.C., an FHA-insured mortgage loan could limit a home buyer’s property choices. These loans are less commonly used in pricier housing markets, and for that very reason.

Borrowers who want to purchase a home that exceeds the maximum FHA loan amount for their area might have to (A) explore alternative financing options or (B) come up with a larger down payment to cover the difference.

But in most parts of the U.S., this is not an issue.

For example, the median home price in the state of Texas is currently around $305,000. The FHA loan limits for that state range from $498,257 (in most counties) up to $571,550 (in the Austin area).

So a home buyer in Texas should be able to finance an average-priced property without bumping into the maximum FHA loan amount for their county.

Comparing Home Prices to Loan Limits

Here’s where you need to start, when considering this program:

- Determine the median home price in the city where you want to buy

- Find the maximum FHA loan amount using the steps provided above

- Consider the relationship between those two numbers

If the median or average sale price in your area is below the FHA loan limit, you shouldn’t have any trouble financing a property through that program.

On the other hand, if you learn that local home prices are much higher than the maximum FHA mortgage size for your area, using that program could limit your housing options.

Ultimately, you have to use the mortgage product that works best based on your particular financial situation and home-buying goals.

How Are These Limits Determined?

So, where do these FHA loan limits come from, and how are they determined? According to a HUD news release that announced the current maximum amounts:

“FHA is required by the National Housing Act (NHA) … to set Single Family forward mortgage loan limits at 115 percent of area median house prices for a particular jurisdiction, subject to a specified floor and a ceiling. In accordance with the NHA, FHA calculates forward mortgage limits by MSA and county.”

In the above quote, “MSA” stands for metropolitan statistical area. The FHA calculates the maximum FHA loan amounts by metropolitan area and county. So the limits are usually the same across an entire metro area, even if that metro includes three or four counties.

You should also know that the maximum FHA loan size can change from one year to the next. They usually adjust upward to keep up with rising home prices.

HUD announces these changes at the end of each year, when they publish the new limits for the upcoming year.

The ‘DTI’ Determines What You Can Borrow

The FHA loan limits mentioned above represent the maximum amount a person can borrow, according to the Department of Housing and Urban Development (HUD).

But HUD does not review your financial situation to determine how much you are able to borrow. The mortgage lender that does that. So ultimately, it’s the lender that determines your maximum loan size.

And this determination largely comes down to your debt-to-income ratio.

Definition: The debt-to-income (DTI) ratio compares your monthly debt payments to your gross monthly income. Lenders generally prefer a DTI below a certain threshold, typically around 43% to 50%.

The combined DTI ratio includes all of your recurring debt obligations, such as car loans, student loans, credit cards and the monthly mortgage payment. A lower DTI ratio indicates that a borrower is less leveraged and may be able to handle additional debt.

According to the Consumer Financial Protection Bureau:

“Your debt-to-income ratio (DTI) is all your monthly debt payments divided by your gross monthly income. This number is one way lenders measure your ability to manage the monthly payments to repay the money you plan to borrow. Different loan products and lenders will have different DTI limits.”

This is one of the most important checkpoints used by mortgage lenders to determine your maximum loan amount. That applies to FHA and conventional mortgage loans like.

Worth knowing: The Federal Housing Administration limits most borrowers to a maximum debt-to-income ratio of 43%. But there are exceptions to this general.