Editor's note: We updated this page in January 2025 to reflect current requirements for FHA debt-to-income (DTI) ratios, based on HUD guidelines.

Here are seven things to know about these requirements:

- FHA loans have certain limits for a borrower's debt-to-income ratio, or DTI.

- These limits help to reduce risk for both the borrower and the lender.

- FHA loans limit the front-end ratio to 31% and the back-end ratio to 43%.

- Borrowers with compensating factors could have a DTI ratio up to 50%.

- Compensating factors include residual income and cash reserves.

- We expect these requirements to remain the same throughout 2025.

- You can learn more about FHA loans by downloading our e-book.

FHA loans generally limit the total debt-to-income ratio to 43% for borrowers. But a higher DTI may be allowable if the borrower has at least one compensating factor, as explained below.

Definition of a Debt-to-Income Ratio

The debt-to-income ratio (DTI) is a percentage that shows how much of a person's income is used to cover his or her recurring debts. Lenders calculate DTI at the monthly level using the borrower's gross, or pre-tax, income.

When it comes to FHA loans, there are two types of debt-to-income ratios. They're commonly referred to as "front-end" and "back-end" ratios.

Front-End DTI Ratio (Housing Ratio)

The front-end DTI ratio focuses solely on your housing-related expenses. To calculate it, you divide the borrower's monthly housing expenses by their gross monthly income.

(Note: The FHA also refers to this as the "Total Mortgage Payment to Effective Income ratio." But we will stick with "front-end" DTI for simplicity.)

To calculate the front-end debt-to-income ratio for an FHA loan, mortgage lenders simply divide the borrower's total monthly housing expenses by their gross monthly income. But only the housing-related debts are used for the front-end calculation.

Example: Let's say a borrower's monthly housing expenses include the following items...

- Mortgage payment: $1,200

- Property taxes: $200

- Homeowner's insurance: $100

- Total monthly housing expenses = $1,200 + $200 + $100 = $1,500

If the borrower's gross monthly income is $5,000, their front-end DTI ratio would equal 30%.

Here's the calculation: The monthly housing cost ($1,500) divided by the gross monthly income ($5,000) = 0.3 or 30%.

In this example, 30% of the borrower's gross monthly income is going toward their housing-related expenses. So their front-end debt-to-income ratio equals 30%.

Back-End Ratio (Total Debt Ratio)

The back-end ratio takes into account all monthly debt obligations, not just housing expenses. This includes mortgage payments, car loans, credit card payments, student loans, etc.

(Note: The FHA also refers to this as the "Total Fixed Payment to Effective Income ratio." But we will stick with the "back-end" term for simplicity.)

The math here is similar to the previous example. Only this time, we would add up all of the borrower's recurring monthly debt obligations. We then divide the borrower's total monthly debt payments by their gross monthly income, to calculate the back-end DTI ratio.

Example: Let's say that a borrower's total monthly debt payments include the following items...

- Mortgage payment: $1,200

- Car loan: $300

- Credit card payments: $200

- Student loan: $150

- Total monthly debt payments = $1,200 + $300 + $200 + $150 = $1,850

If the borrower's gross monthly income is $5,000, their back-end DTI ratio would equal 37%.

Here's the calculation: Total monthly debts ($1,850) divided by the gross monthly income ($5,000) = 0.37 or 37%.

In this FHA loan scenario, 37% of the borrower's gross monthly income is going toward all of their combined debt obligations.

Now that you understand the front-end (housing) and back-end (total) debt-to-income ratios, the rest of this article will make a lot more sense.

FHA Debt-to-Income Requirements in 2025

Next, let's talk about the 2025 debt-to-income ratio limits and guidelines for FHA-insured mortgage loans.

When you apply for an FHA loan to buy a home, the mortgage lender will evaluate your debt-to-income ratio to see if you're qualified for a loan. And it can split the process into two possible paths:

- If you have too much debt in relation to your monthly income, you might have trouble qualifying or undergo additional underwriting scrutiny.

- On the other hand, if you have a manageable level of debt (as defined below), you should be able to clear this checkpoint with ease.

The current (2025) limits for FHA debt-to-income ratios are 31% for housing-related debt, and 43% for total debt. But there are exceptions to these general rules. So don't be discouraged if you're slightly above those numbers.

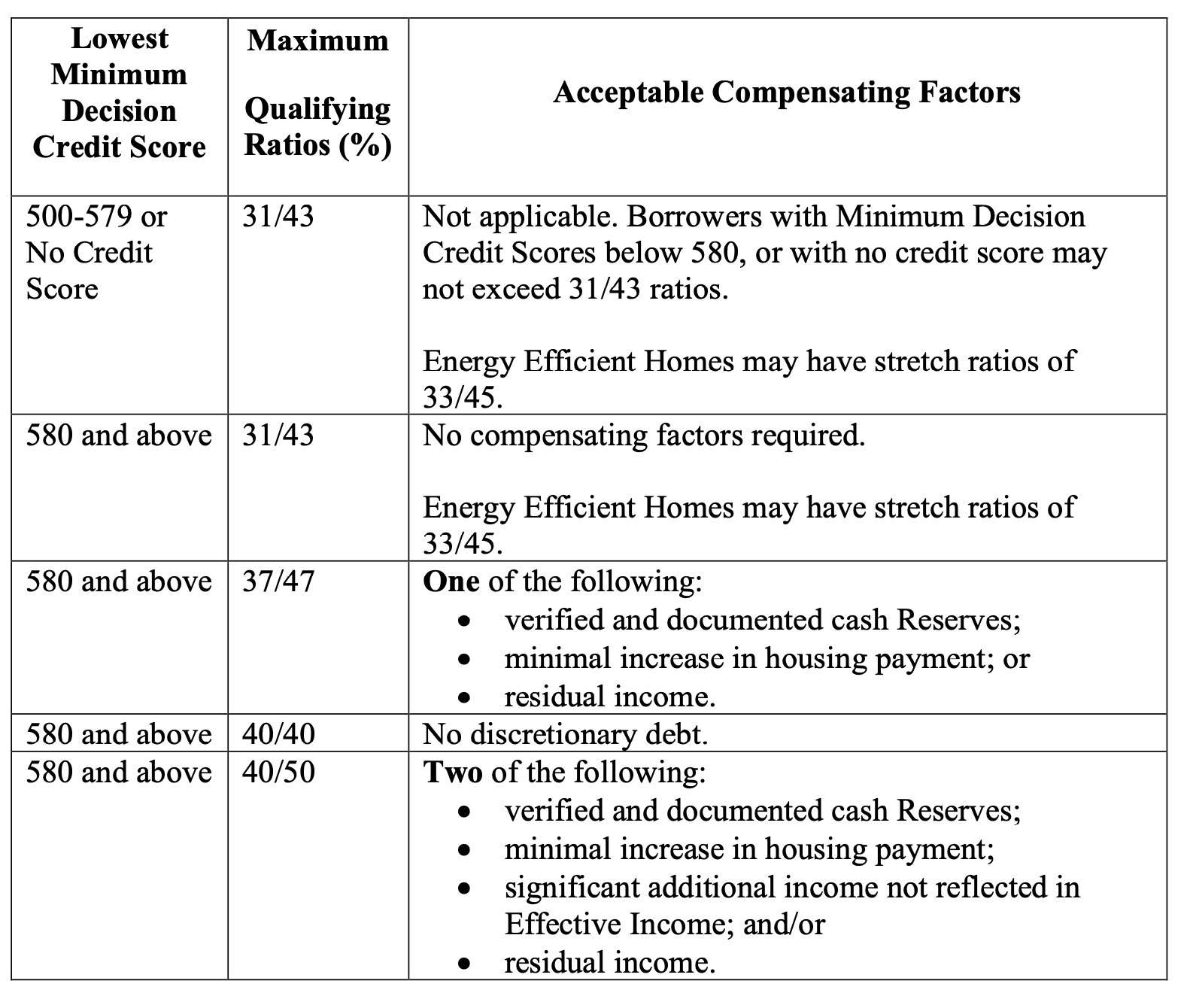

The table below shows the standard DTI guidelines for FHA loans when manual underwriting is used. It also shows some of the compensating factors that could allow a borrower to qualify with a higher debt-to-income ratio.

Note: The above table was copied directly from HUD Handbook 4000.1, also known as the Single-Family Housing Policy Handbook. This is the official handbook for FHA rules, requirements and guidelines, issued by the Department of Housing and Urban Development.

The handbook goes on to state that for all home purchase transactions:

"the underwriter must calculate the Borrower's Total Mortgage Payment to Effective Income Ratio (PTI) and the Total Fixed Payment to Effective Income ratio, or DTI, and verify compliance with the ratio requirements listed in the Approvable Ratio Requirements (Manual) chart."

Understanding Compensating Factors

As with many FHA loan qualification factors, there are some exceptions to the debt-to-income ratio guidelines. The short version is that borrowers who are otherwise well-qualified for financing could be allowed to have a higher DTI ratio than the 43% standard mentioned above.

According to official FHA guidelines, borrowers are generally limited to having debt ratios of 31% on the front end, and 43% on the back end.

But the back-end DTI could be as high as 50% for certain borrowers, particularly those with good credit and/or other "compensating factors."

The Federal Housing Administration gives mortgage lenders some leeway to approve borrowers with DTI ratios higher than the above-stated limits, as long as the lender can find and document "significant compensating factors."

Here's a partial list of compensating factors that might apply.

1. Cash reserves

Lenders can sometimes make FHA loan DTI exceptions for borrowers who have substantial cash reserves in the bank. In this context, "substantial" typically means that the borrower has at least one to three months' worth of mortgage payments in the bank after closing. The exact requirement can vary depending on the loan parameters.

2. Minimal increase

If the home loan being assumed will only result in a minimal increase in the borrower's monthly housing expense, he or she may still qualify for an FHA loan with a higher-than-average debt burden.

3. Residual income

The term "residual income" refers to money that's left over each month after all of your major expenses are paid (including housing, taxes, and debt payments). If a borrower will have sufficient residual income even after the monthly mortgage payment, he or she might be able to exceed the FHA debt-to-income ratio limits shown above.

It's important to note that mortgage applicants don't necessarily have to meet all of these compensating factors. One or more may be sufficient for FHA qualification purposes.

Reference: HUD Handbook 4000.1, Single Family Housing Policy Handbook.

Why Mortgage Lenders Use DTI Ratios

Mortgage lenders use the debt-to-income / DTI ratio to assess your financial health, and also to determine whether you can afford a mortgage.

For conventional and FHA financing alike, the DTI helps lenders understand if you have enough income to cover your monthly mortgage payments on top of your existing debts. Essentially, it's a way for lenders to gauge your ability to manage additional debt responsibly.

Debt-to-income ratios also help FHA loan lenders assess the level of risk associated with lending money to a particular borrower.

A higher DTI ratio indicates that a larger portion of the borrower's income is already allocated to debt payments. That leaves less room for new financial obligations, like a monthly mortgage payment.

Conversely, a lower debt ratio suggests that the FHA loan applicant might be better equipped to handle additional debt. And that's obviously important to a lender.

Last but not least, mortgage lenders examine debt-to-income ratios for FHA loans because the Federal Housing Administration explicitly tells them to.

Remember, these are government-backed mortgage loans we're talking about here. So the government wants to ensure lenders are performing their due diligence when it comes to screening borrowers.

Conclusion and Where to Learn More

To recap, FHA's maximum qualifying debt ratios for borrowers in 2025 are 31% and 43%.

This means the monthly housing payments should not exceed 31% of gross monthly income, while the total debt burden should not exceed 43% of monthly income. But there are exceptions to these rules.

To learn more about FHA debt-to-income ratios in 2025, and the compensating factors that could allow you to circumvent them, you can refer to the Single Family Housing Policy Handbook (HUD Handbook 4000.1).

Disclaimer: HUD makes changes to their FHA requirements from time to time. While we make every effort to keep this website up-to-date, there is a possibility the information presented above will become inaccurate over time. This website is not meant to replace the official guidelines found on the HUD website, but to explain their policies in plain English.